2/13/2015 by sfbayhomes.com

Bad news brewing for certain Homeowners who have HAMP Loans. At-risk property owners who benefited from the federal government’s emergency plan to help them stave off repossession throughout the housing crisis have a brand-new trouble: looming rate of interest increases. Banks began sending notices in June, cautioning that rates for these house owners will certainly soon increase, and with them, regular monthly mortgage payments– by about $200, or almost 25%.

Both the increases and the number of home-owners subjected to increased interest rates it won’t happen all at one time, so government officials are hoping the effect will certainly be silenced. Still, 4 states will be hit with half the nearly 800,000 home loan payment enhances overall– California, Illinois, Florida and New York city– and monthly payments will ultimately increase as much as $1,724, so there was some struggle when the resets struck.

Median regular monthly payment on the loans will climb from $773 to $989, according to a report released by the Unique Inspector General of the Trouble Asset Relief Program.

The House Affordable Modification Program (HAMP), was enacted in 2009, offered Homeowners a chance to modify their mortgages through a series of modifications– usually, interest rate relief that went as low as 2%. Banks received reward payments from the government for each customized loan.

The HAMP program calls for modified loan rates to trend up to market average rates on the fifth anniversary of the change, 1% each year. The greatest rate will differ, however for a lot of HAMP borrowers, it will be around 4% or 5%. That means home-buyers with modified loans in 2009 will certainly see their mortgage interest rates rise to 3% this year, 4% next year, and so on.

A good number of HAMP borrowers will most likely experience 2 or 3 resets.

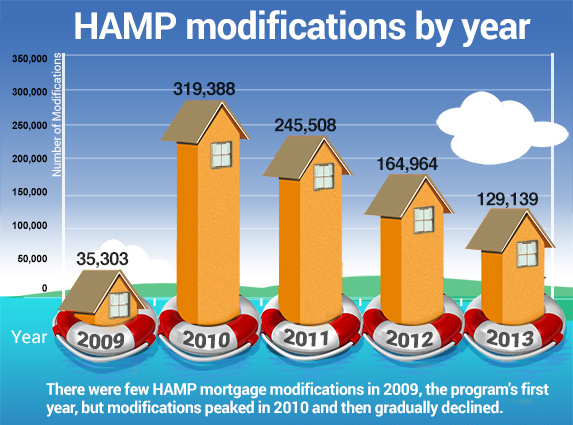

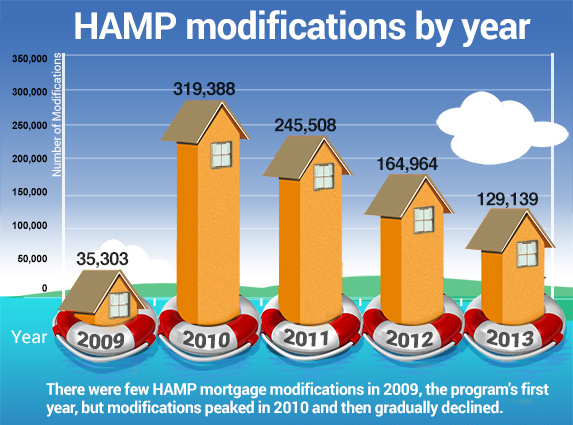

The boosts will certainly hit 88% of property owners who benefited from HAMP– a total amount of 782,000 mortgage holders. Only 30,000 HAMP loans will certainly reset in October, because a low number of HAMP loans needed funding during the program’s very first year. The biggest excess of HAMP resets will certainly be available in 2015, when 319,000 homeowners who got HAMP loans in 2010 will certainly deal with an increase.

The increase does not impact the about 5 million home loan holders who had their loans customized through “proprietary” programs managed straight by their banks. McArdle said the Treasury Department prepares to act if the loan resets threaten to activate more housing problems. He doesn’t want Bad News Brewing for certain Homeowners if it’s preventable.

“We will watch the rate of interest resets to guarantee that if indications of property owner distress emerges, servicers are all set and able to help by providing loss mitigation choices and alternatives to repossession,” he said. Back in March, Treasury ordered larger banks to give financial counseling to mortgage holders, he included.

The rate reduction was not irreversible. The HAMP program calls for customized loan rates to climb back up to market average rates on the fifth anniversary of the change, 1% each year. The best rate will vary, but for many HAMP borrowers, it will be around 4% or 5%. That suggests purchasers whose modified loans in 2009 will see their home loan interest rates increase to 3% this year, 4% next year, and so on.